CELEBRITY

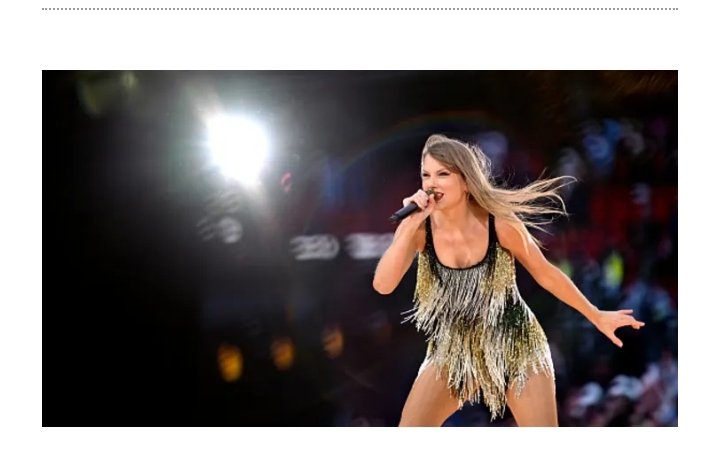

Taylor Swift’s London Eras Tour could delay Bank of England rate cut, analysts say

Taylor Swift’s record-shattering Eras Tour is continuing to supercharge local economies as it enters its U.K. leg.

The economic impact could be enough to defer a possible September interest rate cut from the Bank of England, investment bank TD Securities said in a note Friday.

“Swiftflation” or “Swiftonomics” refers to an uptick in consumer spending, particularly on hotels and restaurants, around the singing sensation’s tour dates.

LONDON — Taylor Swift’s record-shattering Eras Tour is continuing to supercharge consumer spending as it enters its U.K. leg, suggesting that the Bank of England may not be out of the woods yet in its fight against inflation.

As hundreds of thousands of dedicated Swifties flock to London in August to see the singing sensation during her final U.K. dates, the economic boost could be enough to defer a possible September interest rate cut, according to investment bank TD Securities.

“We still anticipate a BoE cut in August, but the inflation data for that month might keep the MPC (Monetary Policy Committee) on hold in September,” the bank’s macro strategist, Lucas Krishan, and its head of global macro strategy, James Rossiter, wrote in a note Friday.

The Bank of England is expected to soon begin lowering its bank rate from a 16-year high of 5.25%, with all but two of 65 economists polled by Reuters anticipating a cut in August, while financial markets are pricing in September.

However, a possible clash between one of Swift’s August tour dates and a key inflation index day could skew the data enough to make the bank rethink its path, the analysts said.

“A surge in hotel prices then could be material, temporarily adding as much as 30bps to services inflation (+15bps on headline),” Krishan and Rossiter wrote.

The BOE did not respond specifically to the comments when contacted by CNBC, but said that “the MPC look at a wide range of economic indicators when they make their decisions on interest rates.”